How to Grow Strategically Part 2

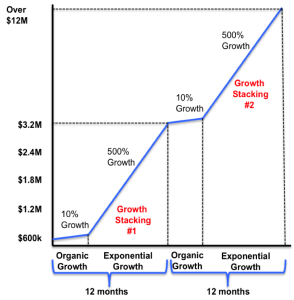

We talked about it in the last article, talked about growing your business through standard marketing methods, and you absolutely must have that as the foundation to the growth stacking method, but when we pile on top of that organic growth, we pile on top that multiple methods to growing, we actually start growing exponentially, kind of like this little graph here. (Yeah you saw this in my last post)

So the very first complex move that we’re going to do when we’re playing this new game, this new exponential growth game, is called a strategic acquisition, which I discussed last week.

So what we’re going to do is, we’re going to look for another company that is not just like ours, but to have at least these three things in common with us.

1. We’re looking for a company roughly that has the same gross revenue, so if you’re a million dollar company, you want to look for someone about $1 million gross revenue.

2. You want to make sure that the company you’re looking to buy, that you’re looking to acquire, has the same types of customers and clients that you do. That’s really important to the process here, because one of the methods we’re going to use here to grow, is called cross-marketing, and it relies on having the same type of clients.

3. Lastly, we want to look for a company that has a lot of duplication of business processes. What this really means is that you want a company that has a lot of the same parts of the business that you do, like human resources, or a sales departments, or has the same kind of, I don’t know, building or trucks, or a lot of duplication of business process and business assets, and I’m going to show you why you want to make sure they have a lot of the same things you do, because that will help you grow a lot faster if you do the strategic buy out.

|

|

So what we’re going to do, is we’re actually going to buy another company that’s roughly the same size as us. On that very day, we automatically double the size of the company through that strategic acquisition.

Now I know technically that’s not a lot of growth, but if your goal is to get to a much, much higher level like the $10 million plus level, then this counts.

So we now have a company that was doing $1 million yesterday, when we do the strategic acquisition, by the way we can do the strategic acquisition with no money down, and actually walking out of these deals with money in our pocket.

Now I don’t have time to go through this today, in the training here I’m going to show you how to get a hold of very soon I’ll show you exactly how to do that, but it’s a little bit beyond the scope of what we can cover in just our few minutes today. So on day one we double the size of the company at the stroke of a pen because we close this strategic acquisition of this complementary company we buy.

Remember we’re not looking for a company exactly like us, we want someone that has those three things that what we’re looking for: the same gross revenue, the type of clients, and has that lots of duplication of business processes and business assets. So here we go, on day one we go from, well in my example here I have a $600,000 company that’s growing at about 10% growth. So we do our one strategic acquisition and now we have a $1.2 million company. Now look these results are not typical, I’m not trying to tell you that this is something that you can absolutely do, but here’s what is possible if you do this the right way, you can go from $600,000 to $2 million overnight.

Now that’s not the end of it though, and that’s exciting now because you’ve just doubled the size of the company but let’s talk about how actual growth occurs, now that you have these two companies, these two complementary businesses operating together to achieve the most growth.

The way this is done, the first step is called the cross-marketing multiplier. Now, you may be asking yourself, can you really double what your business is worth overnight? Well if you buy another company you can. The next way to double the size of the business is to use this cross-marketing multiplier. What this means is that you’re going to take your HVAC plumbing, your contracting services, and you’re going to offer these services to the customers that you just bought with this brand new company that you now own, so you take your services and offer to these customers.

Right then and there you just doubled the size of your customer base so you should essentially be able to double the size of revenue by offering your services to that customer base. Now look, I know in reality there’s a lot nuances here, a lot of ways that this could go wrong, I understand that. But bear with me here because this is still possible, the reality is it could actually go even bigger than double because dependent on the value of the transactions that the other company has, you selling much, much higher price goods could actually increase the value even more.

So let’s say on average you double the size of the company through this very first use of the cross-marketing multiplier. So that’s one use of it. You’ll see right here in the above graph here, we go from $1.2 million to $1.8 million simply by doing the very first cross-marketing, but we’re going to do this again see we’re going to do cross-marketing multiplier again. So the first time you do did it, you offer your HVAC contracting services to the new acquisition company’s customers, but what about the new acquisition company’s products and services? Well you’re going to take those products and services and offer them to your existing clients. Again, being able to double the size of the company, so now you’re about to take this $600,000 company, grow it to $1.2 million by doing this strategic acquisition and I’ll show you how, it’s not quite as complicated as it sounds, and I’ll show you how to put a team together to help you do this, making sure that you do it the right way. Hell you don’t even have to go into the deal with any money, you can actually walk out of these deals with money in your pocket. So now you own a $1.2 million company on the very next day. Then you use cross-marketing multiplier and over the next few months you go from 1.2 million to $1.8 million by marketing your services to their clients. Then you take their services and market them to your clients and now you can potentially grow your business up to $2.4 million. That’s yet another multiple of growth.

So by choosing the right company to buy, the right complementary and not identical company to buy, you take advantage of all the leverage available within this deal. This kind of leverage, this kind of growth is not possible with any other way of growth, and this is how the big behemoths that we talked about in the first video, like GE and Google and all these much larger companies, this is how they’re growing by leaps and bounds faster than any smaller can because they’re using these really powerful methods.

So this method of growth stacking stacks on top of organic growth with strategic acquisition two layers of cross-marketing multipliers, and then the last step is could efficiency profits. Now remember when I said that the very third criteria we have for buying a company is that we want a duplication of services. We want them to have the same HR departments, same sale staff, maybe an extra building, well all these things are things that are assets that you purchased when you bought the company, but if you don’t need them, there’s no reason to continue to pay for them. So what you’re actually going to do is you’re going to shed these extra assets. Maybe you’ll sell the building, maybe you’ll reduce the number of employees you need while still being able to have all the workers that you need for both companies. What this does is it introduces a lot more profit into the deal. So this $600,000 company could very easily still operate on the same amount of staff that a $3.2 million company could if it’s done the right way. Now I can show you how to do that in my product called the contractor exit strategy but it’s a little more deep than we’re going to go to in this article here.

So what you’ve just done is through this exponential growth, and I know we just went over it very, very quickly, but I’m going to give you some homework here so that you can walk away here with the next step that you can take yourself. So we’ve taken a $600,000 company and we have doubled the size with the strategic acquisition, we’ve added another multiple of growths by adding one layer of cross-marketing, doubled it again by adding another cross-marketing, now we have a $2.4 million company and when we add efficiency profits by eliminated all those duplicates within the two businesses, now we can actually grow the business by another multiple. That means that within easily 12 to 14 to 18 months, you can take a $600,000 company and turn it into a $3.2 million company. That’s 500% growth over that time period.

There’s no way organic growth could ever get you there, there’s no way that that organic growth would get you where you want to go, and if we look back at what we did in the first post which is to, well quite frankly get you to a level of true financial liberation when you come to sell the business. This gets you to the ability to sell so much faster for your enough is enough number. If the organic growth alone never got you there but you were able to use strategic and exponential growth like we’re talking about here, you could get to your enough is enough number much more quickly. Then you get to decide when you want to sell it. Now you don’t have to sell it here at this level, in a couple of weeks I’ll talk about exactly how to sell it to the right kind of a buyer, someone that will pay you top dollar for it but what this does is gives you a lot of freedom to sell it whenever you’re ready. You get to pull the trigger at any time you feel is necessary or you could continue to grow.

You could actually put this growth stacking strategy in effect again, you could take that $3.2 million company, continue with, make sure everything gets going good, make sure your first acquisition goes well, you get to the level of growth you want and you could do it again. Then you could take this $3 million company and grow it by another 500% plus get you well over $12 million. Now you’re over the eight figure level we talked about in the first article you should be able to get to your enough is enough number with no problem now.

By using this growth stacking process to build your business. To grow it exponentially using a much, much more powerful strategy than everyone else is using, simply because they’re not aware of it, within smaller companies.

The big companies like GE, these big behemoths, have all these processes down. They know how to use these strategies, but we as smaller business owners don’t always know, but I’m introducing you to this strategy because it’s still just as powerful. Your business is in a real sweet spot of growth where you can take advantage of this like even the big behemoth companies couldn’t. You can reach 500% growth while they can’t quite imagine this kind of growth because they’re so large, but you have the power at your fingertips now to be able to do that. So that the very first step is to get that strategic acquisition but I want you to find out how you can find a complimentary business for yourself. One that you can actually buy. So be on the look at for my next post and we will get you a list of complimentary business for your acquisition.

Thanks again,

Walter Bergeron